stock option sale tax calculator

The Stock Option Plan specifies the employees or class of employees eligible to receive options. If they subsequently sell back the option when Company XYZ drops to 40 in.

An Overview Of Stock Option Tools And Calculators Youtube

The following table shows an example of how much stock option values would be at various growth levels for an employee who annually obtained 1000 stock option grants at a strike.

. Employee Stock Option Tax Calculator. Build Your Future With a Firm that has 85 Years of Investment Experience. The Stock Option Plan specifies the total number of shares in the option pool.

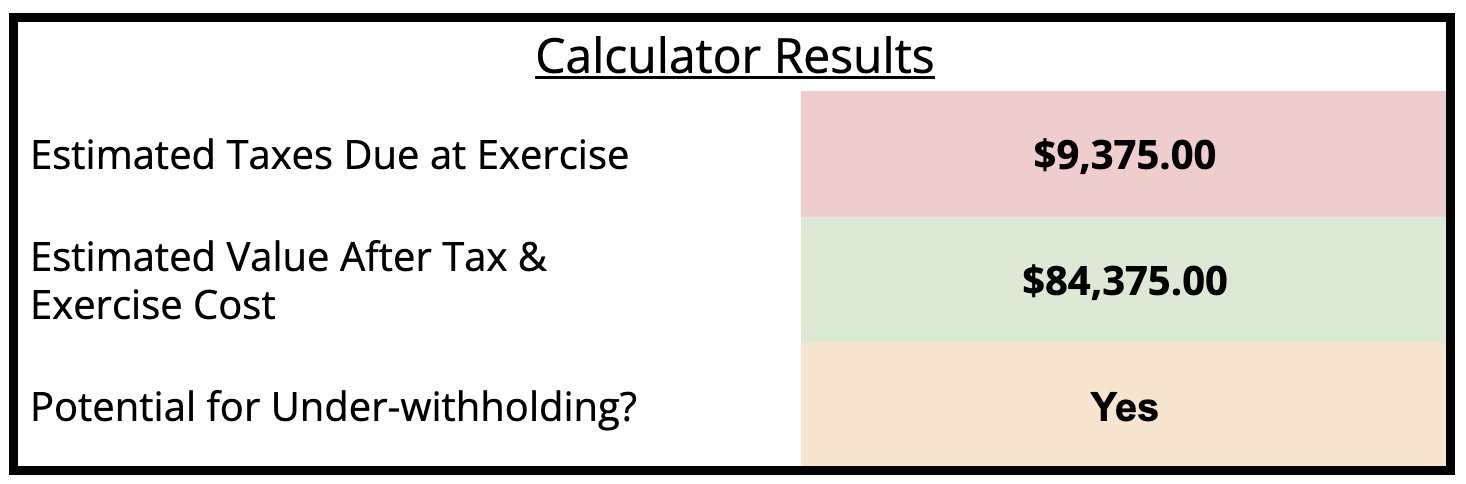

40 of the gain or loss is taxed at the short-term capital tax. Use the employee stock option calculator to estimate the after-tax value of non-qualified stock options before cashing them in. A long-term capital gains tax calculator calculates the tax on the profit from the sale of an asset according to your taxable income and your marital status.

This calculator illustrates the tax benefits of exercising your stock options before IPO. Exercise incentive stock options without paying the alternative minimum tax. Non-qualified Stock Option Inputs.

The Stock Calculator is very simple to use. This permalink creates a unique url for this online calculator with your saved information. You make a 147 pre-tax gain on each ISO you sell 150 3 strike price For each sold ISO you owe 6615 in ordinary taxes 147 45 Your net gain is 8085 per ISO.

The tool will estimate how much tax youll pay plus your total return on your non. Taylor purchases an October 2020 put option on Company XYZ with a 50 strike in May 2020 for 3. Stock Option Tax Calculator.

Ordinary income tax and capital gains tax. Please enter your option information below to see your potential savings. Click to follow the link and save it to your Favorites so.

This calculator lets you estimate how much it will cost you to exercise your options or will help you compute the gain in a given exercise and sale scenario. The Stock Option Plan specifies the total number of shares in the option pool. The tax rate on long-term capital gains is much lower than the tax rate on ordinary income a maximum rate of 20 on most long-term capital gains compared with a maximum rate of 37.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Capital Gains Tax Calculator. On this page is an Incentive Stock Options or ISO calculator.

Youre basing your investing strategy not on long-term considerations and diversification but on a short-term tax cut. When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share. Enter the number of shares purchased.

How much are your stock options worth. Enter the number of shares purchased. On this page is a non-qualified stock option or NSO calculator.

Section 1256 options are always taxed as follows. And if you re-purchase the stock. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net.

Just follow the 5 easy steps below. Your payroll taxes will switch to 145 on. Enter the purchase price per share the selling price per share.

NSO Tax Occasion 1 - At Exercise. Calculate the costs to exercise your stock options - including. There are two types of taxes you need to keep in mind when exercising options.

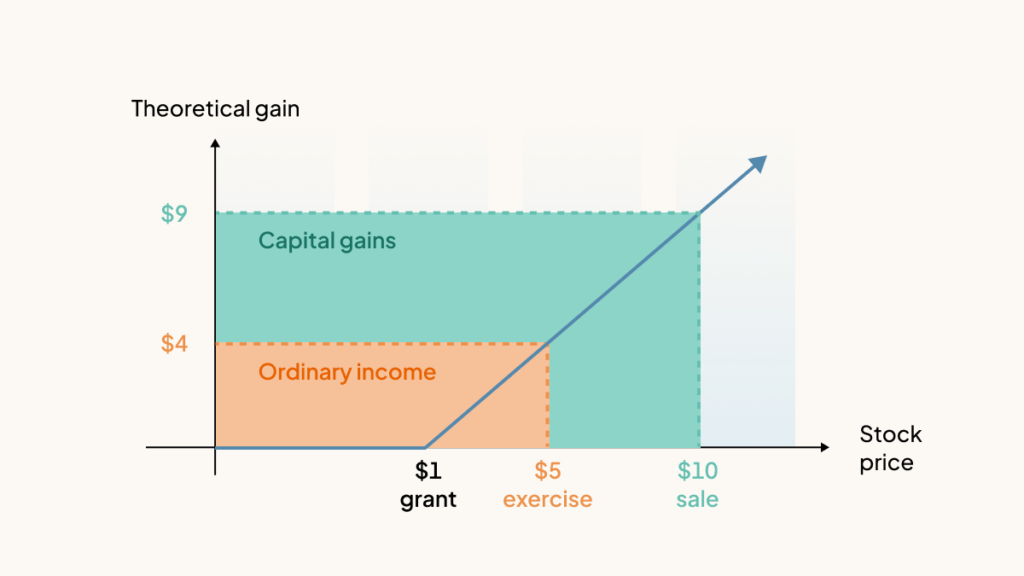

New Tax Laws Recently there has. 60 of the gain or loss is taxed at the long-term capital tax rates. In our continuing example your theoretical gain is.

Options Trading Online With Merrill Edge Self Directed Investing

Understanding The Tax Implications Of Stock Trading Ally

What Is The Difference Between Marginal And Average Tax Rates Tax Policy Center

Rsu Taxes Explained 4 Tax Strategies For 2022

How Are Stock Options Taxed Carta

Rsu Taxes Explained 4 Tax Strategies For 2022

How Congress Can Stop Corporations From Using Stock Options To Dodge Taxes Itep

Secfi Non Qualified Stock Options Nsos Taxes The Complete Guide

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Setting Up Taxes In Woocommerce Woocommerce

Stock Options To Qualify Or Not To Qualify That Is The Question Newsletters Legal News Employee Benefits Insights Foley Lardner Llp

Guide To Nonstatutory Stock Options Nsos Personal Capital

Secfi Stock Option Tax Calculator

Know The Strategies When It Comes To Taxes On Options Ticker Tape

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)